SOLAR ENERGY STEERS ITS FUTURE BY REFLECTING ON THE PAST

(Op-Ed written for WIRE-Net in 2014)

Looking back on the state of solar energy in Ohio, one might perceive the industry as an overfunded passing fancy. Since 2008, Ohio has extended millions in tax breaks, grants and loans to a host of entrepreneurs and businesses in the industry, only to stand by and watch as many of those businesses failed to produce the jobs, sales or potential that they had projected. It’s easy to react to this news by tagging the industry as a short-term fly-by-night sham.

But let’s take a quick look back to the early 1900’s, where a burgeoning auto industry attracted scores of inventors, developers and manufacturers, all vying for a piece of the market. In its infant years, the automobile industry saw literally hundreds of businesses spring up around the country, rolling out new technology and different designs to capture the attention and imagination of a huge mass market that saw the potential in horseless transportation.

It was only through natural attrition that most of these early entrepreneurs eventually shut their doors, for various reasons ranging from bankruptcy or mergers to technical obsolescence and phase outs.

(You can find a complete list of defunct U.S. automobile manufacturers on Wikipedia at http://en.wikipedia.org/wiki/List_of_defunct_automobile_manufacturers_of_the_United_States .)

In the meantime, entire technologies, such as steamers and early electric autos, vanished. But that didn’t mean that cars were a bad bet for the future. Early consumers didn’t revert back to horse and buggy transport because Stanley and Duryea and Ajax ceased to exist.

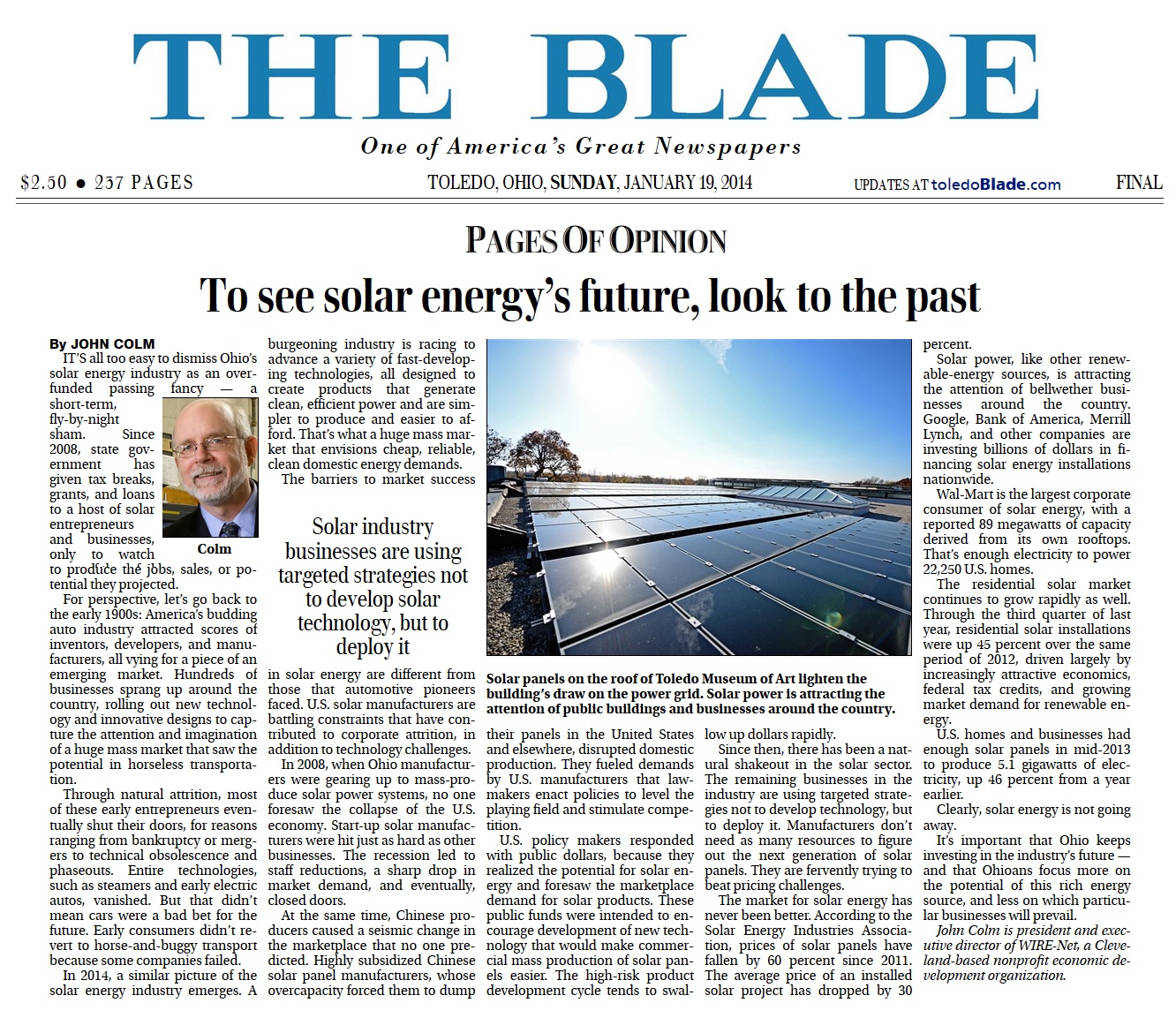

Fast-forward a century or so and picture a solar energy industry that is desperately trying to advance a variety of fast-developing technologies, all designed to result in products that generate efficient power while being simpler to produce and easier to afford. Because that’s what a huge mass market, which envisions cheap, reliable domestic energy, is demanding.

The solar energy industry is presently going through the same early-stage development years as the auto industry of 1906. But it’s a little different than when those automotive pioneers were around. U.S. manufacturers in the solar sector are battling a number of constraints that have resulted in corporate attrition, aside from simple technology challenges.

First, in 2008 when Ohio manufacturers were gearing up to produce solar power systems on a mass production level, no one counted on the collapse of the U.S. economy, which, as we know, affected a lot more than this infant industry. Start-up solar manufacturers were hit just as hard as other businesses, and that resulted in staff reductions, reduced market demand and eventually, closed doors.

And if that weren’t enough, the Chinese stepped in and caused a seismic change in the marketplace that no one predicted. It’s well documented that the highly subsidized Chinese solar manufacturers, whose overcapacity forced them to dump their panels in the U.S. and beyond, disrupting domestic production, fueling a cry to legislators from U.S. manufacturers to do something to level the playing field and stimulate competition.

And police makers responded with public dollars because they realized the potential for solar energy and foresaw the marketplace demand for solar products.

Those public funds were intended to encourage development of new technology that would make solar panels easier to mass produce and take the technology to a commercialization level. Solar developers used those dollars to work through the high-risk “Valley of Death” developmental cycle, which generally tends to swallow up dollars very quickly. And the fact is that the public can’t tolerate the type of risks that are inherent in the R&D cycle

Now we’re approaching 2014 and there’s been a natural shake-out in the solar sector. The remaining businesses are using much more targeted strategies, not to develop the technology, but to deploy the technology. It’s not taking as much work to figure out the next generation of solar panels. Manufacturers now are fervently trying to beat the pricing challenges.

But the fact is that the market for solar energy has never been better. According to the Solar Energy Industries Association, prices of solar panels have fallen 60 percent since 2011, and the average price of an installed solar project has dropped 30 percent.

From a business standpoint, solar (and other renewable energy) is fast attracting the attention of bellwether businesses around the country. Google, Bank of America, Merrill Lynch and others have invested billions in the financing of solar energy installations nationwide. Wal-Mart currently is the largest corporate consumer of solar energy, with a reported 89 megawatts of capacity derived from its very own rooftops, or enough electricity to power 22,250 U.S. homes. (“When we find something that works — like solar — we go big with it,” the company’s website says.)

The residential market continues its rapid growth as well. Through the third quarter of 2013, residential solar installations were up a whopping 45 percent year-over-year, driven largely by increasingly attractive economics, federal tax credits and a growing market for renewable energy.

All told, U.S. homes and businesses together had enough solar panels at the end of the second quarter to produce 5.1 gigawatts of electricity, up 46 percent from a year earlier.

Clearly, solar energy is an industry that is not going to go away. It’s important that Ohio keeps investing in that future and that Ohioans focus on the potential of this rich energy source and less on which particular businesses that will prevail from it.

# # #